- Politics

- Votes: Results

Green light for the 13th state pension payment

10.05.2024 – Theodora Peter

The Swiss want bigger state pensions. In a historic result on 3 March, voters emphatically approved a trade union initiative calling for an additional 13th pension payment.

SP politician and head of the Swiss Trade Union Federation, Pierre-Yves Maillard, was elated at the result. Photo: Peter Schneider, Keystone

The electorate has never backed a left-wing initiative to expand the welfare state. Until now. Over 58 per cent of voters – as well as 15 out of 23 cantons (see map) – approved the proposal for an additional monthly old-age and survivors’ insurance (OASI) state pension payment. There was jubilation among the authors of the initiative and their allies, the SP and the Greens. “This is historic,” said Pierre-Yves Maillard, head of the Swiss Trade Union Federation.

Only a decade ago, a similar initiative calling for a 10 per cent increase in the state pension failed resoundingly at the ballot box. But the balance has shifted. More and more people do not have adequate pension income – state, occupational and private – to maintain their standard of living in retirement. The rising cost of rents, electricity, and health insurance are also making pensioners worse off. The additional OASI pension payment, which equates to a pension increase of 8.3 per cent, offsets this drip-drip loss of purchasing power, say the authors of the initiative.

It was a sobering referendum result for the political right, which had massively underestimated the depth of feeling on the issue. The SVP, normally good at reading the room, was blindsided by its rank-and-file voters. Representatives of business argued that the pension boost was too expensive and would lead to higher social security contributions and higher taxes. But that didn’t sway the voters this time.

The Swiss Abroad and their pensions

With 65 per cent voting yes, the Swiss Abroad approved the initiative even more emphatically than their domestic counterparts. This was after the No campaign had focused attention on the “Fifth Switzerland” (and on foreign workers who return to their home country after retirement). The SVP warned of the “luxury pensions” that retirees abroad would supposedly rake in, or were already raking in, due to the strong Swiss franc and a lower cost of living. This provoked a strong reaction from expatriates – retiring on a tight budget is motivation for many to move to a different country in the first place. Our magazine received numerous messages from expats saying they would struggle to make ends meet in Switzerland – even though they could have been claiming supplementary benefits had they not emigrated (which, ironically, would have cost the taxpayer even more).

Effective from 2026

The additional pension payment would be paid out from 2026 in accordance with the Yes campaign’s wishes, the Federal Council assured the country after the vote. At the time of our editorial deadline, there was still uncertainty on how to backstop the state pension increase. Higher salary deductions or a further increase in VAT are two possible options. The Centre has also broached the idea of a tax on financial transactions. According to government estimates, the 13th OASI pension payment will cost around four to five billion Swiss francs every year. The annual state pension bill currently amounts to some 50 billion.

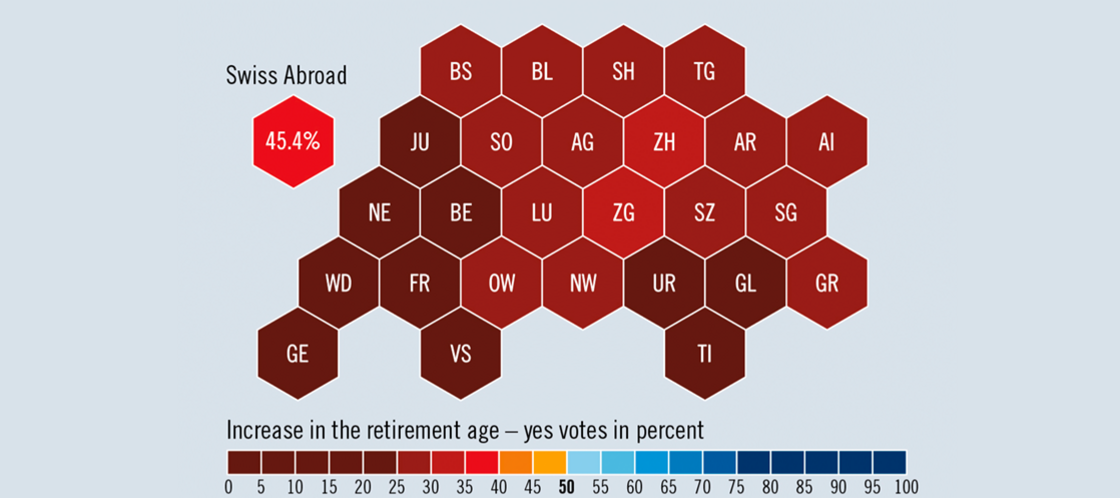

No increase in the retirement age

Raising the retirement age is now off the agenda after a proposal from the Young Liberals was rejected on 3 March when a whopping 75 per cent voted against it. The authors of the initiative wanted to initially increase the male and female retirement age from 65 to 66 and then peg it to average life expectancy. However, the idea failed to find support among the electorate.

Overview of the federal votes on 9 June 2024

Initiative to cap health insurance premiums

The SP wants to boost state relief and place a cap on health insurance premiums. Under its proposal, no policyholder would pay more than 10% of their income on health insurance premiums. This would mainly ease the financial burden on families while protecting purchasing power. Opponents of the initiative warned of prohibitive costs for the government. Parliament is in favour of moderate premium reductions via cantonal subsidies. (TP)

Cost brake initiative

The Centre is trying to reduce health insurance premiums by putting a brake on healthcare costs. The aim of its initiative is to force policymakers to intervene if healthcare costs rise excessively relative to general wages. Opponents fear this would lead to a reduction in policyholder benefits. Instead of a cost brake set in stone, parliament wants the Federal Council to stipulate cost and quality targets every four years. (TP)

Initiative against mandatory vaccination

Critics of Covid restrictions during the pandemic have tabled an initiative calling for an end to mandatory vaccination. Their proposal goes too far, say opponents. It is already the case that no one can be vaccinated against their will. In an epidemic, vaccination can be made mandatory for certain types of groups at increased risk of exposure and/or hospitalisation. People in these groups who subsequently fail to get vaccinated can be excluded from certain types of work, e.g. at hospitals. (TP)

Federal Act on a Secure Electricity Supply from Renewable Energy Sources

Parliament has approved a law that lays the foundation for the rapid expansion of Switzerland’s energy production from renewable sources such as hydropower, solar and wind. The Franz Weber Foundation has called a referendum to contest the bill, arguing that the construction of solar farms and wind turbines has a detrimental effect on flora, fauna and the natural landscape. Supporters of the measure include most of the political parties as well as major environmental organisations like the WWF and Greenpeace. (TP)

Crowd at Bern train station. Photo: Sebastian Meier / Unsplash

Comments

Comments :

Ich verstehe die “Inland”-Schweizer, welche das Abstimmungsrecht der Auslandschweizer limitieren wollen. Sie müssen mit den getroffenen Entscheidungen leben, die Auslandschweizer (mehrheitlich) nicht. Die “Schweizer Revue“ sollte nur in den Schweizer Landessprachen erscheinen. Jene Auslandschweizer, welche diese nicht verstehen, sollten eine solche lernen, um dazu zu gehören.

D'un point de vue strictement économique, il aurait été plus raisonnable de diminuer les coûts, freiner la spirale des prix, du logement à l'alimentation, réduire la consommation, plutôt qu'augmenter les retraites par un 13ème mois. Ce choix est significatif de l'incapacité des populations à comprendre qu'il faut sortir enfin du "toujours plus", du dogme de la croissance, des ressources tenues pour illimitées. Une politique qui s'avèrera tôt ou tard suicidaire.

Ich bedaure den Entscheid. Maillard hat nicht redlich gehandelt. Die Finanzierung ist überhaupt nicht geklärt und ein Grossteil der Rentner benötigt die 13. Rente nicht wirklich. Eine sehr populistische Initiative, welche den Schweizern noch zu schaffen machen wird.

Was heisst hier "nicht über die Menschen..."?!? Das Problem ist schliesslich ein menschliches, und genug mit der Entmenschlichungspolitik auf Kosten der zahlenden Menschen!

Zum AHV Entschluss: Diese Initiative kam positiv zustande, nicht weil alles teurer wurde, sondern der Hauptgrund liegt in der ganzen Finanzpolitik unseres Bundes. In den letzten Jahren wurde bald jedem bewusst, wohin die Steuergelder wandern. In aller Landen werden Millionen, gar Milliarden verteilt, unter dem Mantel Hilfsgelder, Entwicklungshilfe, usw. Es ist schön, dass dies die Mehrheit geschnallt hat. Und im Mantel der sozialen Wohlfahrt ist ein grosser Handlungsbedarf!

Concernant la 13 ème rente AVS, certains se demandent comment elle sera financée? Comment ont été financés les 109 Milliards de Francs pour sauver le Crédit Suisse? Est-ce qu’on vous a demandé votre avis? Qu’en est-il des fameux crash tests mis en place auparavant, qui garantissaient qu’une telle débâcle financière ne puisse avoir lieu?

Le CS a reçu un crédit. Il sera repayé. L'AVS est une dépense éternelle. Très différent! Mais comme vous, trop de gens ont argumenté! Incroyable!

N.B.: Keiner lebt ewig!

Was war die Lebenserwartung, als die AHV geschaffen wurde? Wesentlich tiefer als heute. Es macht somit Sinn, dass das Pensionierungsalter angepasst werden müsste. Mal sehen, wie die Rentenerhöhung erreicht werden kann. Jemand muss dafür bezahlen!