- Politics

- Votes: Results

Retirement age for women is rising to 65

09.12.2022 – DENISE LACHAT

The ‘vote of the year’ was a tense moment for women. They voted No by a large majority on the reforms to the old-age and survivors’ pension (OASI). However, they were narrowly defeated. Women will have to work for one more year before they are able to draw their pension. The reform of the occupational pension scheme is pending, and should see women better off.

First there was anger. Tensions broke out on 26 September, the day after the vote on the OASI pension reforms, including in Bahnhofsplatz in Berne. National Councillor for the Socialist Party Tamara Funiciello proclaimed heatedly into the microphone, in front of several hundred female demonstrators, that the outcome of the vote was simply disgraceful. “Old, rich white men” had decided that women in Switzerland would have to work for one extra year in the future.

“Men decide that women will have to work one year longer” Tamara Funiciello, National Councillor, SP, Berne

Indeed, a majority of men had voted to raise the retirement age for women to 65, against the will of the majority of women. The disparity between the sexes was particularly marked during this vote: two thirds of the women who voted (63%) came out against the reform, whereas only around one third of men (37%) voted No. However, a majority of (largely urban) women also contributed to the exceedingly close outcome of the vote. These women also came under fire from Funiciello. The centre-rightnational and state councillors had, she said, done absolutely nothing for the cause, of equality aside from making empty promises. The exasperated reaction from urban politicians was not long in coming: in the days following the vote, pot shots were launched from both sides, and there was talk that women in Switzerland were divided.

Improving women’s situation in old age

Subsequently, further conciliatory opinions came to the fore. There is not one single definition of feminist politics, and not all women have to be equal, the way not all men are, said Maya Graf in an comprehensive interview with the “Aargauer Zeitung” newspaper. Graf, the Green Party state councillor for Baden, has, together with Green Liberal National Councillor for Berne Kathrin Bertschy, co-chaired Alliance F, the umbrella organisation for women in Switzerland, since 2014. Alliance F had both a Yes and a No committee for the pension vote. Other questions were met with unanimity, such as equal pay for the same work and paid childcare. A crucial point to note in the wake of the debate on the retirement age for women is the observation that women of every political inclination are demanding that women’s situation must be improved when they retire.

“Not all women have to be equal either” Maya Graf, Green Councillor of State, Basel Land

Old-age pensions for many women are unsatisfactory, but this is not primarily the OASi’s fault. Since the major OASI reforms in 1997, the first pillar of the old-age pensions has greatly improved for women: education and childcare credits were introduced, together with provisions for sharing the pension between spouses. This sharing scheme involves totalling up the income earned during marriage by both spouses and using it to calculate the pension by giving half to each spouse.

Gaps in occupational pensions

The greatest difference between the sexes is the yawning gap in the second pillar: mandatory occupational pensions (OPA). Because women often earn less than men, their wage contributions to their pension fund are lower. Anyone who works part-time or who works in an industry with low salaries undertakes voluntary care work or is simply paid less for doing the same work can expect their retirement assets to be scant. The pension based on these assets is correspondingly small, especially as wages that are not only poor but also fall under a certain annual income level (currently 21,510 Swiss francs) are not covered by compulsory insurance. The focus in the wake of the narrow Yes vote on OASI pension reform is now on revising OPA pensions. The core issue is putting those working low hours or with a low income in a better position to be able to save privately for their retirement.

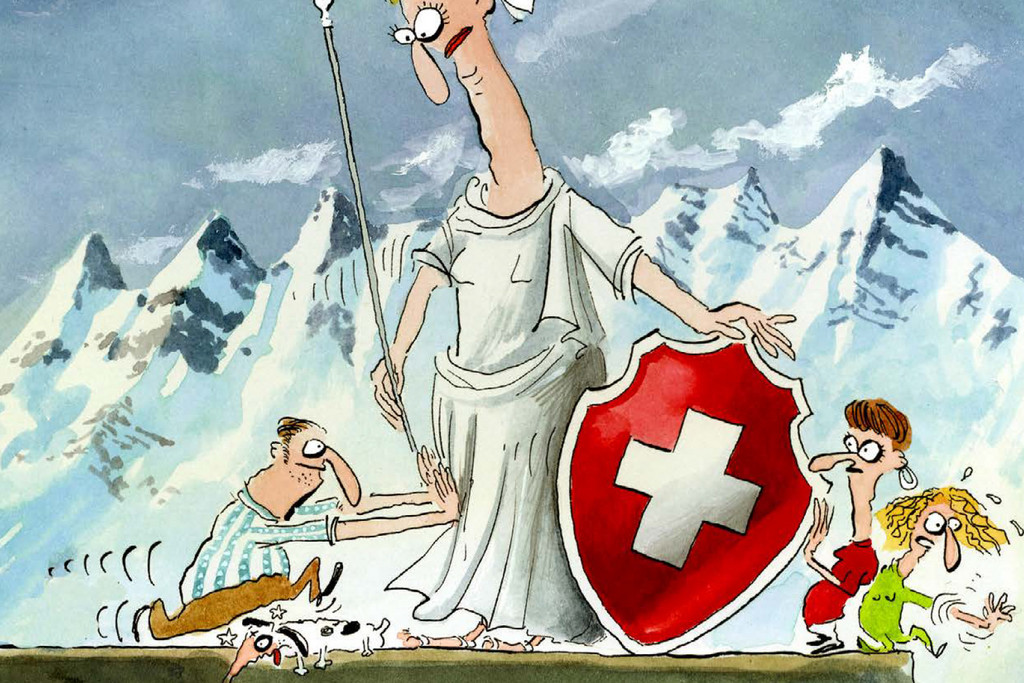

“Dini Mueter isch hässig” (Your mother is furious): one of the slogans brandished by women protesting against the results of the OASI vote. Photo: Keystone

However, the second pillar suffers from similar issues to the first one: long life expectancies have made it more challenging to finance pensions, and this problem has been exacerbated by low interest rates. The yields from pension funds are too low to be able to convert policyholders’ retirement assets into pensions that will remain at current levels over the long term. An additional and complex long-term debate is when – and indeed whether – a ‘revision for women’ needs to take place at all.

The allegation that the larger number of women in parliament since the 2019 elections have achieved nothing is dismissed by the co-chairs of Alliance F. They cite the example of the women’s session organised in autumn of 2021, which brought two dozen petitions before parliament. Furthermore, women argued that additional issues should be discussed in parliament, such as individual taxation, the financing of childcare, a review of the law on sexual offences, marriage equality including access to reproductive medicine and the financing of a programme to prevent domestic violence. The key bills are already in progress, Maya Graf says in the “Aargauer Zeitung”. This also includes reform of the OPA.

Retirement age for women

The retirement age for women was the focal point for debate in this reform of the old age and survivors’ pension (OASI), and not for the first time. In 1948, when the OASI was introduced, the retirement age was 65 for both men and women. The fact that parliament unilaterally reduced women’s pension age to 63 in 1957 and then to 62 in 1964 appears an expression of antiquated values today. Women are more prone to illness and their strength fails sooner – the arguments put forward by men in those days. The “Tages Anzeiger” called it a “patriarchal show of strength”, designed to ensure that women would be back to looking after the home a couple of years before their husbands’ retirement. Whatever the situation, the retirement age for women was progressively increased in 2001 and then in 2005, to 63 and then 64. Three additional attempts at securing equality were voted down or defeated in parliament. After the fourth attempt on 25 September 2022, the age has now returned to 65 for both genders.

The three pillars of old-age pensions

The maximum OASI pension is currently CHF 2,390 per person per month, and the minimum pension in most cases is CHF 1,195. These OASI pensions alone are not enough to live on in Switzerland. Two further pillars are required. In addition to the State OASI pension and supplementary benefits (1st pillar), an occupational pension from the pension fund was created in 1985 (2nd pillar). Finally, legally regulated private pensions (3rd pillar) have existed since 1987. The aim of this 3-pillar system is to ensure people will be able to maintain their accustomed standard of living when they retire.

Comments